W4 calculator 2020

TurboTax Team should clarify the Withholding on the earlier screen Enter Your 2021- W2 Wage Information to say 2021 YTD Withholding. This will give you an idea of whether.

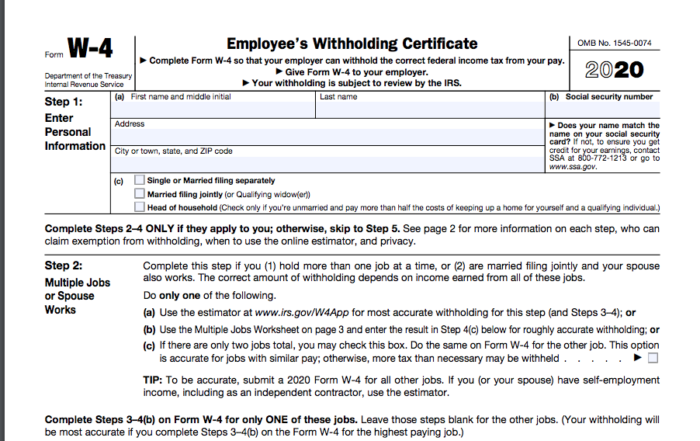

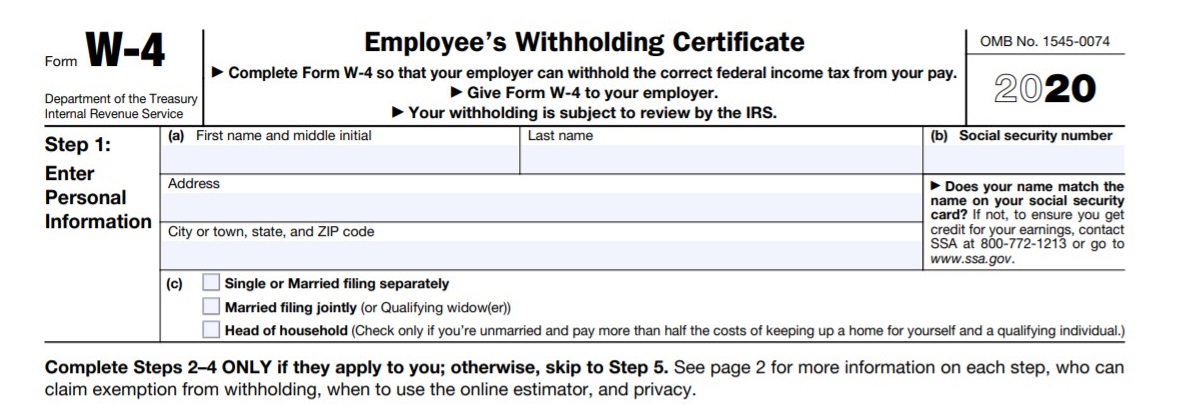

How To Calculate 2020 Federal Income Withhold Manually With New 2020 W4 Form

IRS tax forms.

. Otherwise it is confusing because. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Then look at your last paychecks tax withholding amount eg.

Give it a Try. Since early 2020 any change made to state withholding must be made on Form OR-W-4 as the new federal Form W-4 cant be used for Oregon withholding purposes. Submit or give Form W-4 to your employer.

Up to 10 cash back Maximize your refund with TaxActs Refund Booster. 250 and subtract the refund adjust amount from that. Our free W4 calculator allows you to enter your tax information and adjust your paycheck.

Download or Email IRS W-3 More Fillable Forms Register and Subscribe Now. On Any Device OS. Free 2022 Employee Payroll Deductions Calculator W-4 with Exemptions Use this calculator to help you determine the your net paycheck.

Enter your taxable income from Form OR-40 line 19. Complete Edit or Print Tax Forms Instantly. The 2020 Tax Calculator uses the 2020 Federal Tax Tables and 2020 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here.

Ad Access IRS Tax Forms. For help with your withholding you may use the Tax Withholding Estimator. You dont need to.

The information you give your employer on Form W4. 2021 Personal income tax calculator. Do not use periods or commas.

This calculator uses the old W-4 created before the. 250 minus 200 50. W4 Calculator for calculating how much federal income tax youre going to withhold during the course of the tax year.

To keep your same tax withholding amount. Adjust a previously created W-4 based on your 2020 Tax Return or 2021 Tax Return results in 2022. Recommended for planning the future based on the past.

W4 Calculator 2022. That result is the tax withholding amount. Ask your employer if they use an automated system to submit Form W-4.

You can use the Tax Withholding.

The New Form W 4 Form Is Different Really Different Asap Accounting Payroll

Federal And State W 4 Rules

Learn About The New W 4 Form Plus Our Free Calculators Are Here To Help Paycheck Manager

Irs Improves Online Tax Withholding Calculator

Estimate Your Paycheck Withholdings With Turbotax S Free W 4 Withholding Calculator Simply Enter Your Tax Information And Adjust Y Turbotax Tax Refund Payroll

New 2020 Form W 4 Employee S Withholding Certificate Payroll Services

Challenges Of The New Form W 4 For 2020

Help In Preparing For 2021 Tax Season Financial Analysis Taxes Humor Bank Jobs

W 4 Form What It Is How To Fill It Out Nerdwallet

Form W 4 Employee Tax Forms Job Application Form Math Models

Pin On Pregnancy

Free W 4 Calculator Tax Withholding Info For Hr Professionals Goco Io

Payroll Calculator In Microsoft Excel Microsoft Excel Templates Themes Top Techniques To Cal Learning And Development Communication Skills Excel Templates

2020 Form W4 Changes Abacushcm

Learn About The New W 4 Form Plus Our Free Calculators Are Here To Help Paycheck Manager

Tax Withholding Calculator For Employers Online Taxes Federal Income Tax Tax

W 4 Form What It Is How To Fill It Out Nerdwallet W4 Tax Form Tax Forms Online Broker